Stay alert. Minimize non-payment. Protect your cashflows.

Be our bureau partner FREE of charge.

Obtain timely information on the payment behaviour of your customer accounts.

Monitor your liquidity, mitigate risks and improve your cashflow.

Utilising Trade Payment Information

Our Trade Information Enables You To:

- Determine When You Are Likely To Be Paid - Help You Minimize Your Day Sales Outstanding (DSO) And Ultimately Profitabilty.

- Compare How Efficient Your Customers’ Payment Are To You Relative To Their Suppliers

- Analyse Payment Trends & Predict Potential Delinquency

Payment Bureau Singapore Helps You In:

- Making Better, Faster, And More Informed Credit Decisions With Objective And Consistent Data

- Improving Collections

- Minimising Slow Payments By Customers

- Pre-Screening Best Prospects

Features

Industry Benchmarking

Benchmark your payment trends against industry standards to have a clearer insight on your business portfolio and how you are performing, all in real-time.

PAYDEX Access

Gain access to our proprietary PAYDEX, an indicator which shows a firm’s payment behavior over the past year, based on trade experiences reported by various vendors.

Real-Time Notifications

With our Payment Tracker, receive real-time notifications when there are any changes to your business partners’ payment activity.

Payment Dashboard

The interactive dashboard gives you a bird’s-eye view of your payment portfolio, offering a wider perspective to aid in your business decisions.

Payment Profile Report

Access your business partner’s Payment Profile Report, where you can analyse payment trends and predict potential delinquency.

Tradelines Monitoring

Staying abreast of any defaults or abnormal payment behaviours by your business partners can help you to mitigate risks.

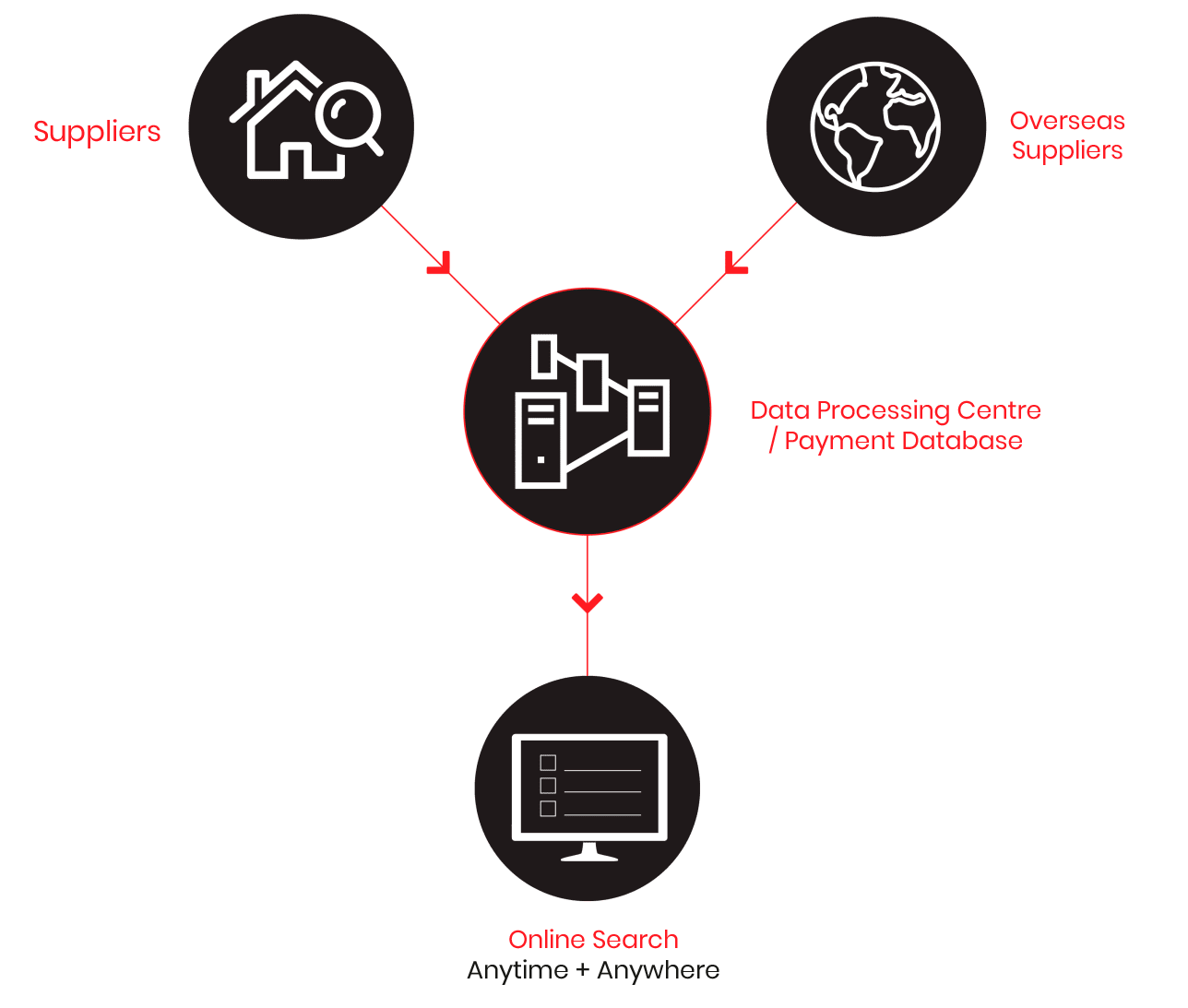

How It Works

1) Source

Suppliers’ contributions will be channelled to a staging area

2) Processing

Information will be processed into a consistent format before deployment

3) Deployment

Processed data to be made available to users through the dashboard

Beyond helping your business to benchmark aging performance against the general industry, PBS monitors and notify you of errant payment activities to enable quick response. It is a free essential tool that not only supports risk management, but serves as leverage during a negotiation.

By comparing your business against industrial norms during negotiations, you can leverage for advantageous terms (such as better credit terms) to improve your cash flow and financial position.